New data suggests the U.S. housing market hit a turning point in its supply struggle in May, as active inventory recorded the first year-over-year increase since June 2019, according to the Realtor.com® Monthly Housing Trends Report released today. At the same time, the median national home price soared to an all-time high of $447,000 and buyers snatched up listings a week faster than last year. The median listing price in Metro Phoenix hit an all-time high of $550,000 in May, a year-over-year increase of 22.2%.

The acting listing count in Metro Phoenix has seen a year-over-year increase of 67.1% and new listings are up 13.7%.

“Among key factors fueling the inventory comeback are new sellers, who are listing homes at a rate not seen since 2019, as well as moderating demand, with pending listings declining year-over-year in May,” said Danielle Hale, Chief Economist for Realtor.com. “While this real estate refresh is welcome news in a still-undersupplied market, it has yet to make a dent in home price growth, partially due to increases in newly-listed, larger homes and because the typical seller outlook is quite high, likely shaped by recent experiences of homeowners who sold. Importantly, as 72% of this year’s sellers also plan to purchase a home, seller expectations will likely start to reflect buyers’ needs. In an early sign, the rate of sellers making price cuts accelerated in May.”

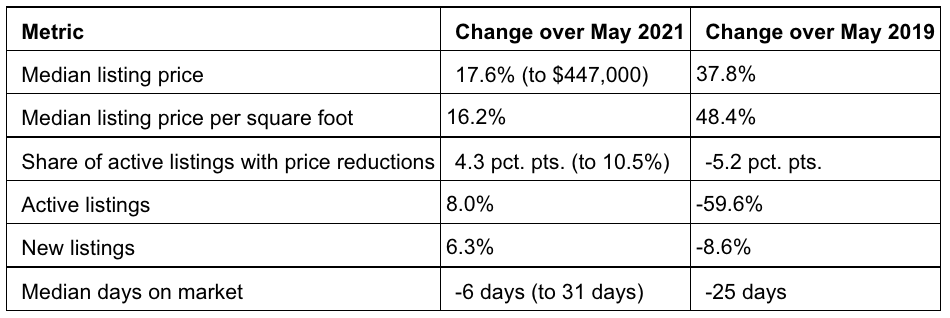

May 2022 Housing Metrics – National

Inventory grows for the first time in three years, as more new sellers enter the market

The U.S. inventory of active listings grew year-over-year for the first time since June 2019, with this comeback driven by two key trends. First, new listings reached the highest level of any month in nearly three years, as rising numbers of sellers might be more confident in pursuing plans to list than last Spring when COVID vaccines were just rolling out. Second, higher housing costs are spurring a moderation in buyer demand. This is reflected in May’s bigger year-over-year declines in pending listings – those at various stages of the selling process that are not yet sold – compared to April, a sign of softening in the turnover rate of for-sale homes.